One of my pet peeves is when I’m reading a reputable source and a reporter uses the terms “high income” and “wealthy” incorrectly or inter-changeably. Obviously, income is how much money comes to a person within a given time period, and wealth is how much in assets a person has accumulated over time. This miscommunication creates confusion, misperceptions, and sometimes, poor policy.

I see this mistake all the time. For example, a few weeks ago I read an article in a financial publication where the reporter wrote that the wealthy pay most of the Federal income taxes in the United States, and then went on to discuss high-income earners. Clearly, the US Federal tax code is based on taxing income and those with high incomes (typically “earned” income) pay the most in taxes every year. The wealthy can and do a lot to change the way in which they generate income from assets, and try to do so in a tax-efficient way. Since a majority of the wealthy people in our country are near- or current-old age retirees, I generally don’t have a problem with the way the tax code works.

This week I read an article which noted a study where over a 40-year period, 70% of the population made it into the top 20% of earners for at least one year, but that only 21% of the population remained in the top 20% of earners over a ten-year period (https://www.wsj.com/articles/earnings-in-the-u-s-a-game-of-chutes-and-ladders-11560511801 – behind a paywall, unfortunately). This shows that being a high earner in the US is within the reach of many people, but building any amount of wealth requires disciplined saving over time because counting on repeated huge paydays is unlikely.

I have seen many cases over the years of people who have a couple of high-earning years, but then return to more average earnings. An example in the high-tech industry is salespeople. A salesperson may have a great year and earn over $1,000,000 in compensation and commissions. This results in a massive tax bill as a high-income earner in that year (and usually an increase in lifestyle spending). But the company employing the salesperson inevitably changes the salesperson’s favorable territory or commission rules, and the success doesn’t repeat for long. But the lifestyle spending increase does repeat, the tax bill helped deplete the income from the one lucky year, and not much wealth was created.

Another example is many of the residents of the town in which I live. It has one of the highest median incomes in my state, but is much further down the list in median family wealth. As described in the book The Millionaire Next Door, many of my neighbors look wealthy with fancy new cars, vacations, and big houses, but use much of their income to pay bills while accumulating little wealth.

What are the biggest limits to wealth creation? Lifestyle expenses and income taxes, and there is an interesting link between the two. When someone earns more money, she typically believes that she deserves an improved lifestyle – new car, nice vacations, bigger house, maybe a second house, etc. And once someone has lived that way, she wants to continue living that way, so there is a creep upward in on-going expenses to support lifestyle. Then at retirement, those people also want to continue that standard of living, so having higher lifestyle expenses pre-retirement means that more dollars have to be saved out of today’s income for future expenses associated with maintaining lifestyle. But, that conflicts with spending more today, while also having to pay more in taxes.

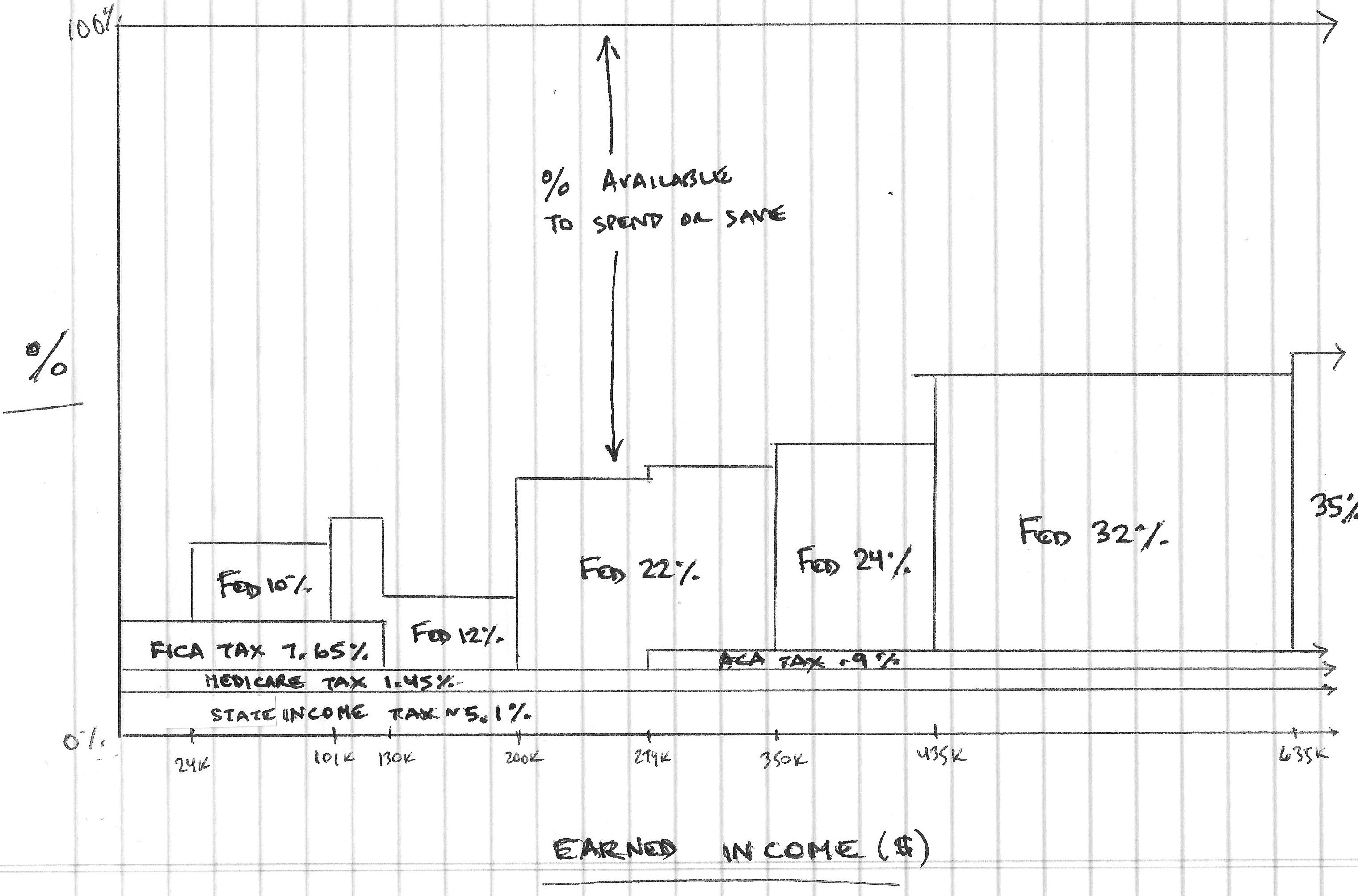

Thus, I tell my high-income friends that since about 35-40% of income goes to all forms of taxes (income, property, excise, sales, etc.), the remainder should be split between lifestyle spending and savings (about 30% each). This limits today’s spending and saves adequately for the future. The reaction is usually priceless – why should they spend less on lifestyle than what they pay in taxes? – but our system is designed so that the high-income people pay the bills for our country. Conversely, the “good” news for the people who earn less is that with less lifestyle expense pre-retirement, Social Security covers a larger percentage of retirement income needs later, enabling a higher percentage of today’s income to be spent on lifestyle, with less needed for taxes and savings.