There have been studies I have seen recently that showed from where a student graduated is much less financially-impactful than what major the student chose. A sociology degree from Harvard typically leads to substantially less income over a lifetime than does an engineering degree from State U. Yet the degree from Harvard (unless the student qualifies for substantial financial aid) is going to cost a multiple of the degree from State U. So why do parents who cannot qualify for financial aid from schools that don’t provide merit (the Ivies, for example) still push junior to attend Harvard if she is going to be a music or sociology major?

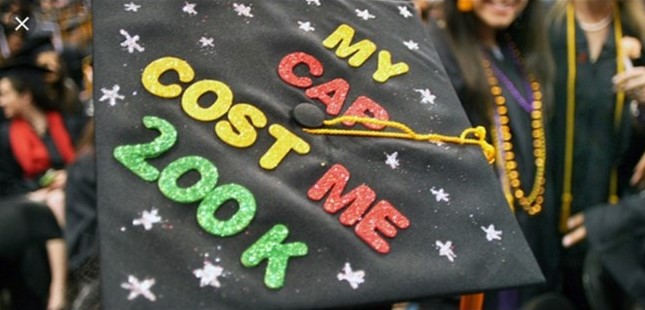

I live in a town where parents push their children to go to the most prestigious colleges possible, regardless of major, cost, financial aid, or merit money. I have come to the opinion that this is more about the parents’ egos than the best possible decision for their children, especially when it means that the family won’t qualify for financial aid or receive merit. Many of my children’s friends have substantial debt from attending college that will haunt them for many years, but their parents were happy to brag about where junior attended college for a few years. And of course, the students were very happy to show off their fancy private college shirts for the last few weeks of high school, because once they got to college, everyone is wearing the same (very expensive) shirt.

I have read many interviews from college students and recent college graduates saying that they never understood how student loans worked, how much debt they were accruing, or how it would impact their financial lives after graduation. Because of this, they exclaim, neither they or their parents should have to repay the debt from attending their fancy colleges – and Bernie, Elizabeth, and other politicians in their quest to buy votes, agree! Politicians believe that ignorance (or professed ignorance) should let anyone and everyone off the hook. I wonder if the police or IRS would take that excuse – sorry IRS auditor, I didn’t know that I owed income taxes as a 1099 contractor, so I’m good, right?

My wife and I struggled with developing an approach where our children would truly own the college decision – good or bad – without trying to directly influence the decision as a parent. We came up with an approach that has worked for our first three children relatively well (the fourth and last child still in high school). The approach is to tell the child upfront how much money we could afford for his or her college education, a “budget,” and let them decide how to use that budget to pay college expenses. Any money remaining from the budget after completing a degree is theirs to keep, but we manage the money and pay the bills until graduation.

For example, our oldest child was accepted at several NESCAC colleges, along with acceptances from an equally highly-ranked (US News and World Report) private school a bit further away and our state’s flagship university. I didn’t know much about NESCAC, but around here, it is the next best parental-bragging rights behind the Ivy League, MIT, and Stanford. Of course, the NESCAC schools didn’t offer my daughter any merit money (money the school offers to sweeten the offer of attendance, separate from financial aid) but the other schools offered a sizable sum. Since my daughter knew that the merit money was going to end up in her pocket after graduation, she decided to pass on the NESCAC schools and attend the private school a few states away. She tells me now, after graduating several years ago, that it was the right decision for her even though she didn’t get the same ego boost for a few weeks in high school.

There are other benefits of this approach that we’ve discovered along the way. For example, it motivates junior to graduate in four (or less) years – more money left in the budget after graduation! Also, many of my friends’ children are constantly negotiating with their parents to cover different daily expenses in addition to tuition, room, and board. For my kids, that all comes out of the budget, so the semester abroad, the books, the weekend trips, the athletic team costs, etc. etc., all have a direct financial impact to my child that she or he takes much more seriously than if it was a negotiation to get more from dad and mom.

We developed this approach for our children when they were very young, so I could put the college savings in the correct accounts. Since 529s have restrictions on how the money can be used, I didn’t want all of a child’s college savings in a 529 if she ended up going to a less-expensive state university. So I split the college savings, putting four years of a state university’s costs in the 529, and the remainder in a Uniform Gift to Minor’s Account (UTMA). I also was able to have different asset allocation models for each child based upon when he or she would be entering college. When my child was young, all the money was invested in equities and when my child entered junior year in high school, I moved mostly to cash over time depending upon the equity market.

We all try to do our best as parents, and I’m not claiming our approach here is perfect. A good friend was quite adamant with me that we were providing an incentive for a poor outcome (he believes a less expensive school will deliver a worse education and experience than an expensive school) and that a child can’t make such an important financial decisions. But, isn’t the student making that financial decision implicitly – why not make the decision explicit?